Great River Stories

Mark Skaj

Chairperson

Hello Members,

My name is Mark Skaj, and I am the Chairperson of the Board of Directors for your Great River Federal Credit Union. The Board of Directors is made up of members who volunteer their time and talent to set short-term and long-term goals, review policies, procedures, and financial information for the credit union.

If you are interested in representing the membership and helping to lead the credit union, consider joining the Board of Directors as a Director or an Associate Director.

Visit our website for more details about board responsibilities, the benefits of becoming a board member, and an application. I look forward to hearing from you.

Don’t Fall Prey

to FRAUD

Don’t Fall Prey

to FRAUD

Fraud is an ever-growing concern. In a climate rife with increased fraudulent activity, both businesses and consumers are more susceptible than ever to fraudulent schemes. We want our members to be aware of fraud and its trends and how it could affect them.

What is Fraud?

Fraud involves intentional trickery where a victim is treated unfairly to gain financial advantage.

When does it become a crime?

It becomes a crime when someone deceives to deprive a person or organization of their money or property.

Identity Theft

This occurs when someone steals your personally identifiable information (PII), such as your social security number, driver’s license, or email address, and uses it to commit fraud, including taking out loans, mortgages, credit cards, renting apartments, opening other bank accounts in your name, or even filing taxes under your identity.

You may realize you’re a victim of identity theft when:

- You receive a credit card or bank statement in your name for charges you didn’t make.

- Your credit score shows unexplained changes, or you’re contacted by a debt collector.

- You receive notice from USPS about your mail being forwarded or missing mail, especially from financial institutions.

- You receive medical bills from an unfamiliar doctor or wrongfully denied health insurance claims due to benefit exhaustion.

- You receive notification from a company you do business with that your information has been affected by a data breach.

Get More Fraud Prevention Tips In Our Full Newsletter

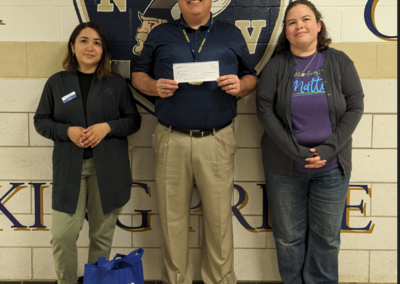

Community Involvement Matters!

In Our Newsletter:

Ways to Protect Yourself from Fraud, Great River College Loans, Jacobs Financial Estate Management Advice, & More!

Federal Law requires us to tell you how we collect, share and protect your personal information. Our policy has not changed. You may review our Privacy Policy or we will mail you a copy upon your request. Call 320.252.5393 for questions.