Keeping Up with Teens

Forget the next chapter, teenagehood is a whole new book! These years are time of change, growth, and discovery. We believe their bank accounts should reflect that. That’s why we have developed checking and savings accounts specifically made for teens! Whether your teen needs the convenience of a Visa® Debit Card to access cash or you like the idea of being able to monitor their spending, we’ve got you and your teen covered.

Want to add a Visa Debit Card to your teen’s existing savings account?

You can reach a Member Advisor by calling 320.252.5393 or by scheduling an appointment.

Teen Accounts Overview

- Ages 13 – 17

- An initial $5 deposit signifies membership at GRFCU

- FREE – No monthly charges

- Earn dividends on balances of $10 and above (Savings Accounts only)

- Visa Debit Cards available

- Digital Banking & Mobile App

- Unlimited transactions at GRFCU owned ATMs and Co-Op Network

- eStatements & Text Alerts

- Teen Rewards Program

- Direct Deposit

- Spend & Save Program

Add Your Great River Debit Card

to Apple, Google, or Samsung Pay!

Add card to Apple Pay

Add card to Google Pay

Add card to Samsung Pay

Round Up Your Purchases & Save!

With Our Spend & Save Program

Enroll in our new Spend & Save program! Every time you swipe your Great River Debit Card, it will round your purchase to the nearest dollar and the difference will automatically go to your savings account! Easily track your transactions through our mobile app or online banking.

= $4.65 Rounded Up = $5

SAVED = $0.35

= $2.50 Rounded Up = $3

SAVED = $0.50

= $26.02 Rounded Up = $27

SAVED = $0.98

A high five from a moose isn’t cool anymore.

That’s why teens get their own rewards program.

The Details

Account Opening: Instead of just getting a high five, teens will receive a really cool BlenderBottle® and Pop-It, when opening a new membership with us.*

Rewards for Saving: Every time you deposit $20 or more into a Teen Savings Account at one of our branches, a member of our team will initial the rewards card. All you need is 10 deposits to be rewarded.**

Good Grade Incentive: We all know that good grades matter. So if you have good grades, bring in your report card, and receive a free movie ticket!*

Access to Online Banking and Mobile App

Transfer funds between accounts

Obtain up-to-the minute information

View debit card information

Set account alerts and notifications

View account history

Mobile Check Deposit

Search ATMs

New Peer-to-Peer Transfer Service – Coming Soon!

You can use our external transfer solution within our Online Banking to send money until our new peer-to-peer solution powered by Payrailz® is available.

External Transfers

Easily move money between your account(s) and other financial institutions.

- Save Time – No need to visit branches.

- Schedule automatic, recurring transfers for a simple savings plan.

- Control your money from one dashboard — fast and easy.

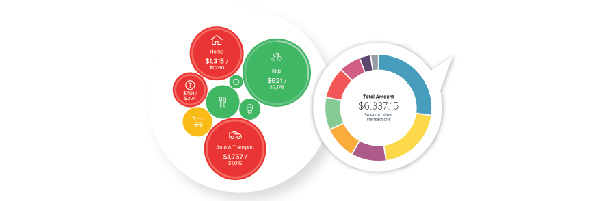

Money Management

Budgeting for a brighter future.

An aggregate view of all transactions from internal and external accounts. Users can filter the view by account or date, as well as search the dataset for any keyword or amount. Other functions include the ability to add manual transactions and to export the list to a .csv file.

Open an Account to become a Member!

Open Online

Complete our online membership

application within minutes!

Schedule an Appointment

Speak with a Member Advisor via Great River

Go Live video chat or at a branch.

Things to Remember when Opening an Account:

- Parent/legal guardian needs two forms of identification. One has to be a state identification card, driver’s license, or passport (please note if the address isn’t valid on their ID, they’re required to provide proof of address). The second form of ID can be a social security card or debit/credit card with their name on it.

- Parent/legal guardian must qualify as the joint owner when under the age of 18

- Minor’s social security card is required at account opening

Guidelines aren’t our favorite, but here they are:

*Benefits and giveaways are for open and active GRFCU Members between 0 and 18 Years of age. Giveaway values vary. Teen BlenderBottle® retail value is $10.99. All other giveaway items have a retail value of $10 or less. No purchase necessary. A purchase will not increase your odds of winning.

**One punch per business day no matter the amount above $20 minimum. Must have card in person during each transaction. Offer is subject to change at any time.

Note to Parents: The Children’s Online Privacy Protection Act (COPPA) require we inform parents how we collect, use, and disclose personal information from children under the age of 18.

Great River Federal Credit Union does not solicit or collect information from children anywhere on our website. In fact, we do not require any visitors to our web pages to submit any personal information to access our site.

Great River Federal Credit Union may display third party links to various children’s sites on our Youth/Teen web page, however we do not distribute any personally identifiable information to third parties. When navigating to these children’s sites please verify that the third party’s web site contains a Children’s Privacy Policy that discloses their information practices for children’s personal information, and your rights as parents to provide parental consent; and opt-out guidelines regarding the collection, use, and distribution of children’s personal information to other third parties.

This card is issued by Great River Federal Credit Union pursuant to a license from Visa USA Inc.

Checking Accounts

There are many benefits of joining Great River Federal Credit Union.

Student Loans

We’re committed to helping students find the best funding for their education through collge student loans.

BECOME A MEMBER

Your story may bring you here in celebration, because of exciting future plans, or a life changing event. Maybe you are struggling and looking for help, or perhaps going to the credit union is an errand in your day. All of these stories matter to us!